Markets are currently pricing in a pause in the Federal Reserve’s interest rate hike next month. A step that will come before the central bank cuts interest rates twice before the end of 2023, according to market pricing.

But a new report from interest rate strategists at Bank of America Global Research on Thursday suggested that pricing means one of two things — either the Fed’s rate hike isn’t over yet, or the cuts will be deeper than markets expect.

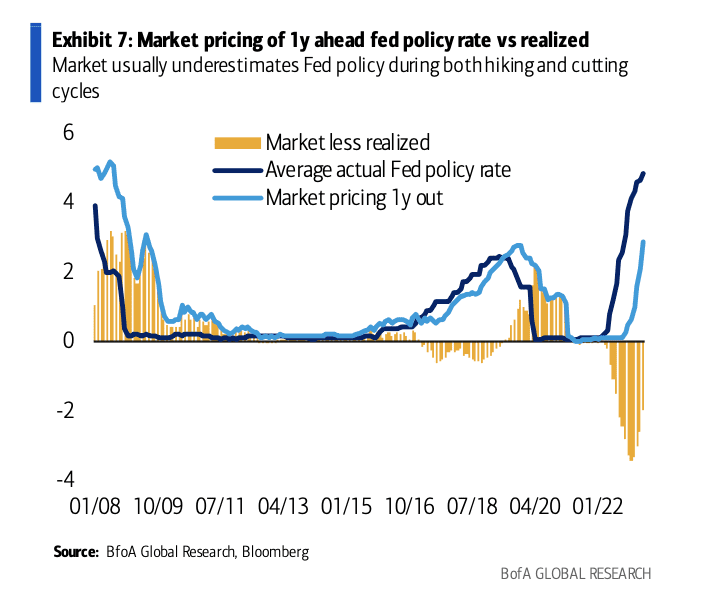

Bank of America strategists led by Megan Sweber write: “Historically, the market has tended to underestimate actual Fed policy before both hitchhiking and cutting cycles: the market will often price very few rate cuts before the cutting cycle and very few hikes.” before a hiking session. In a note to customers on Thursday.

Many economists considered Fed Chairman Jay Powell’s press conference on May 3 to indicate a “hard pause,” or a tendency toward halting rate hikes while approaching more hikes than rate cuts.

“Looking ahead, we will take a data-driven approach in determining the extent to which additional policy stabilization may be appropriate,” Powell said in prepared remarks during his news conference. “No decision has been made about a pause today,” Powell added in response to a question about the Fed’s next move.

Economic data has largely broken in the Fed’s favor since then. Inflation rose at its slowest annual rate in two years in April and the latest jobs report showed evidence of a significant enough slowdown in the labor market for the Federal Reserve to halt future rate hikes, in the view of some economists.

After the release of inflation data on May 10, markets were pricing in more than 95% of the chance of a Fed pause in June, according to data from the Chicago Mercantile Exchange.

But those expectations slowly eased as some members of the Federal Open Market Committee – which votes on Fed policy – offered their views on the economy ahead of the Fed’s next policy announcement on June 14.

On Thursday, Dallas Fed President Lori Logan, a voting member of the Federal Open Market Committee, cast doubt on halting the Fed’s most aggressive rate hike campaign in four decades.

“After raising the target range for the federal funds rate at each of the last 10 FOMC meetings, we have made some progress,” Logan said. Tell audience in San Antonio. “Data in the coming weeks may show that it is appropriate to skip a meeting. Even today, though, we’re not quite there yet.”

Investors will listen closely to Powell’s comments on Friday when he sits down with former Federal Reserve Chairman Ben Bernanke at an event in Washington, DC.

The data is from CME as of Thursday show up Chances of a rate hike next month rose to 36% from 28% after Logan’s comments. However, stocks appeared largely unfazed, with the Nasdaq Technologies Index rising more than 1% on Thursday.

“These probabilities haven’t been true throughout this entire cycle,” Brian Levitt, global market analyst at Invesco, told Yahoo Finance Live on Thursday. Therefore, it is possible that we will see another price hike.

Whether the Fed chooses to raise or lower interest rates in the coming months, Bank of America simply notes that the scale of the move is likely to surprise the markets.

“If the Fed begins a easing cycle later next year as our economists expect, the Fed may deliver more cuts than is currently priced one year in advance,” the company wrote.

Josh is Yahoo Finance Correspondent.

Click here for the latest stock market news and in-depth analysis, including the events that move stocks

Read the latest financial and business news from Yahoo Finance

“Infuriatingly humble analyst. Bacon maven. Proud food specialist. Certified reader. Avid writer. Zombie advocate. Incurable problem solver.”

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/liberation/QU3MDIWR65HTBHHIPB4G5VRFZA.jpg)

More Stories

The rise in oil prices due to the Saudi and Russian production cuts

Bitcoin, Ethereum, Dogecoin Soar After SEC Ratings BlackRock Card ETF, Fidelity ‘Not Enough’ – Analyst Says King Crypto Could Hit $310K If Institutions Do

Los Angeles hotel workers go on strike