The Bank of Canada’s QT started much earlier and is ahead of the Fed’s QT.

by Wolf Richter for Wolf Street.

On the Bank of Canada’s balance sheet released on Friday, total assets of C$439 billion are down 24% from their peak in March 2021 (C$575 billion). In comparison, the The Fed’s balance sheet peaked in April 2022. The Bank of Canada (QT) quantitative tightening began in essence in April 2021 and is ahead of the Federal Reserve’s QT. We’ll get to the details and the funny look in a moment:

The biggest quantitative easing asset classes, gone or beginning to emerge:

repo: The Bank of Canada’s repo holdings peaked in June 2020 at C$210 billion, and then started to decline. Most are gone by June 2021, and by June 2022 almost all are gone. Now there are only C$400 million left, awaiting maturity (green line in the chart below).

canada treasury bondsThe short-term Canadian Treasury bills that the Bank of Canada began buying in March 2020 peaked in July 2020 at C$140 billion. At that point, the Bank of Canada started letting them off the balance sheet as they matured. In March 2021, it announced that it would allow their repos to go to zero, Quoting “moral hazard” as the reason. By September 2021, most T-bills had disappeared. By April 2022, they were completely gone, and they’re still gone today (purple line).

Mohammed bin Salman: The Bank of Canada has never bought that many “mortgage bonds” for a start. It peaked at less than C$10 billion in late 2020. In October 2020, the Bank of Canada said it was ending its MBS purchase entirely, concerned about the Canadian housing bubble. It has since shrunk due to pass-through capital payments and has remained a very small component, down to C$9 billion (yellow line).

Government of Canada (GoC) bonds: This is a biggie, the main quantitative easing tool. In October 2020, the Bank of Canada announced that it would cut its GoC bond purchases from C$5 billion per week to C$4 billion per week — but don’t call it “decreasing,” it said at the time, though it was clear-the old decrement. .

In April 2021, by then She owned 40% of outstanding government bondsreduced its purchases of GoC bonds to C$3 billion, citing “signs of Inductive Expectations and Speculative Behavior“In the housing market. In July 2021, the Bank of Canada issued Reduced purchases to C$2 billion per week.

In October 2021, the hammer was discontinued. In a surprising move, with inflation rising, it announced that it would do so to terminate its entire GoC bond purchases effective November 1, 2021The outstanding bonds will be allowed to roll over without redemption. There are no “maxims” on GoC bonds that roll. Whatever matures, rolls over. The sudden announcement caused revenue to rise.

This was the start of the official Qt even though total assets had already fallen due to buybacks and Treasury bills which had mostly disappeared.

The Bank of Canada’s holdings of Canadian government bonds peaked at the end of December 2021 at C$435 billion and have declined in the eight months since then by 12.6%, or by $54 billion, to C$381 billion (red line).

Compensation: Losses in its securities holdings.

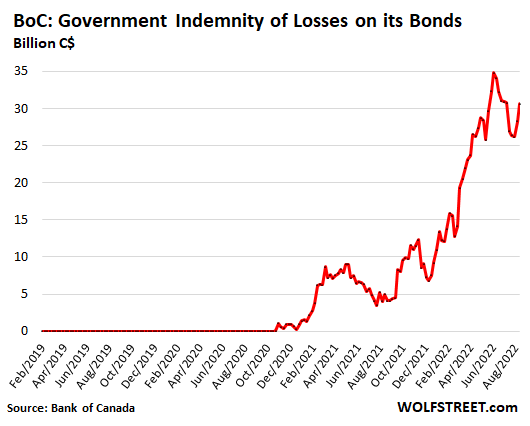

Notice the brown line in the chart above – now the second largest asset, ‘compensation’. This is the estimated value of compensation agreements between the federal government and the BoC. It represents estimated losses from the Bank of Canada’s securities holdings if it were to sell them at current prices, which the federal government would then compensate for.

As part of this quantitative easing frenzy that began in March 2020, the federal government agreed to compensate the Bank of Canada for any actual losses incurred in its bond portfolio. These losses were expected to accumulate when bond yields begin to rise, as they have been doing since early 2021.

The BoC prepares the loss estimate as an asset in this balance sheet. If the BoC is actually paid by the government for these losses, the amount will be reduced by reimbursement. This account is a form of receivable owed to the BoC by the federal government, for losses in bond holdings.

When returns go up, those losses go up. When yields go down, losses go down (all bondholders suffer from this). During the summer’s bear market rally that continued in Canada, as well as in the United States, from mid-June through mid-August, yields fell and bond prices rose.

But this gathering ended in mid-August. Since then, yields have risen, bond prices have fallen, and estimated losses have risen again.

The chart below details those estimated compensation, based on estimated losses. These compensation peaked on the balance sheet on June 15th at C$35 billion. Then, with lower revenues and lower losses, the value of compensation also declined, reaching as low as C$26 billion on the balance sheet on August 10. On the August 24 balance sheet, which was released on Friday, it jumped again to C$31 billion:

Enjoy reading WOLF STREET and want to support it? Use ad blockers – I totally understand why – but would you like to support the site? You can donate. I appreciate it very much. Click on a glass of beer and iced tea to learn how to do it:

Would you like to be notified by email when WOLF STREET publishes a new article? Register here.

“Infuriatingly humble analyst. Bacon maven. Proud food specialist. Certified reader. Avid writer. Zombie advocate. Incurable problem solver.”

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/liberation/QU3MDIWR65HTBHHIPB4G5VRFZA.jpg)

More Stories

The rise in oil prices due to the Saudi and Russian production cuts

Bitcoin, Ethereum, Dogecoin Soar After SEC Ratings BlackRock Card ETF, Fidelity ‘Not Enough’ – Analyst Says King Crypto Could Hit $310K If Institutions Do

Los Angeles hotel workers go on strike