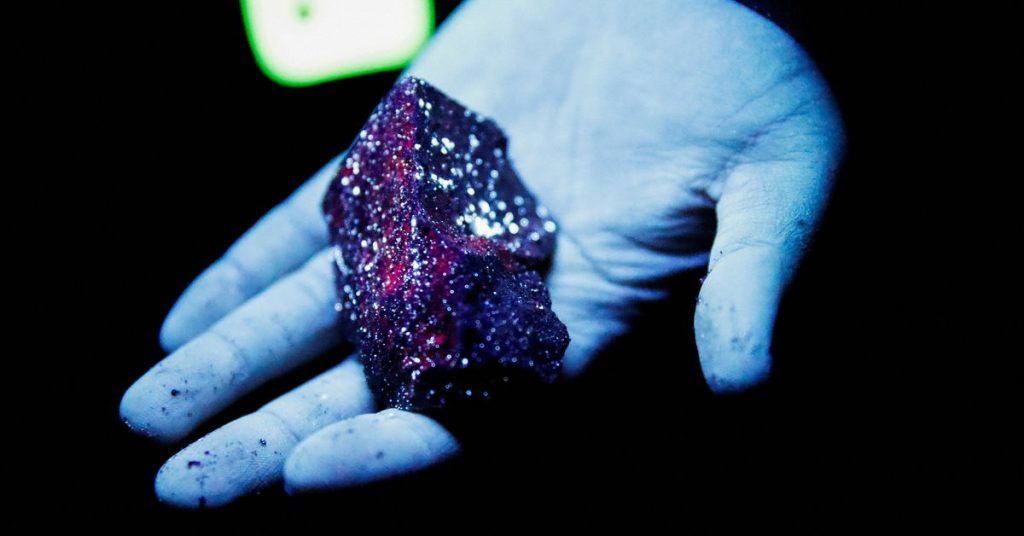

SANG-DONG, South Korea, May 9 (Reuters) – The blue tungsten winking from the walls of abandoned mines, in a town that has seen better days, may be a catalyst for South Korea’s attempt to break China’s dominance of important minerals and claim its claims. future materials.

The mine in Sangdong, 180 kilometers southeast of Seoul, has been brought back from the dead to extract the rare mineral that has found new value in the digital age in technologies ranging from phones and chips to electric cars and missiles.

Lee Dong Seop, Vice President of Almonty Korea Tungsten Corp.

Register now to get free unlimited access to Reuters.com

“Resources have become weapons and strategic assets.”

Sangdong is one of at least 30 globally significant mines or mineral mills that have launched or reopened outside of China over the past four years, according to a Reuters review of projects announced by governments and companies. These projects include developing lithium in Australia, rare earths in the United States and tungsten in Britain.

The scale of the plans illustrates the pressure countries feel around the world to secure supplies of critical minerals that are essential to the green energy transition, from lithium in electric vehicle batteries to magnesium in laptop computers and neodymium in wind turbines.

The International Energy Agency said last year that overall demand for these rare earths is expected to quadruple by 2040. He added that for those used in electric vehicles and battery storage, demand is expected to grow 30-fold.

Many countries view their mineral drive as a matter of national security because China controls the mining, processing, or refining of many of these resources.

The Asian powerhouse is the largest supplier of vital minerals to the United States and Europe, according to a study conducted by the Chinese Geological Survey in 2019. Of the 35 minerals that the United States classified as critical, China is the largest supplier of 13 species, including the study found that rare earth elements Essential for clean energy technologies. It added that China is the largest exporter of 21 major metals in the European Union such as antimony used in batteries.

“In the important raw materials restaurant, China is sitting eating dessert, and the rest of the world is in the cab reading the menu,” said Julian Keitel, senior vice president of minerals and mining at consultancy Wood MacKenzie.

The stakes are especially high for South Korea, home to major chip makers such as Samsung Electronics. The country is the world’s largest per capita consumer of tungsten and relies on China for 95% of its imports of the metal, which is famous for its unmatched strength and heat resistance.

China controls more than 80% of global tungsten supply, according to CRU Group, commodity analysts in London.

The mine in Sangdong, a once bustling town of 30,000 people now home to just 1,000, has one of the world’s largest tungsten deposits and could produce 10% of the world’s supply when it opens next year, according to its owner.

Louis Black, CEO of Almonty Industries, the parent company of Canada-based Almonty Korea, told Reuters it plans to bring about half of the processed process’s production to the home market in South Korea as an alternative to Chinese supplies.

“It’s easy to buy from China, and China is South Korea’s largest trading partner, but they know they are overly dependent,” Black said. “You should have a Plan B by now.”

Discovered in Sangdong in 1916 during the Japanese colonial era, tungsten was once the backbone of the South Korean economy, accounting for 70% of the country’s export revenue in the 1960s when it was largely used in metal cutting tools.

The mine closed in 1994 due to a low supply of the metal from China, which made it commercially unviable, but now Elmonte is betting on this demand, and prices will continue to rise driven by the digital and green revolutions as well as the growing desire by countries to diversify their sources of supply.

European prices of a minimum of 88.5% of paratungstate – the main raw material ingredient in tungsten products – are trading around $346 a ton, up more than 25% from last year and close to five-year highs, according to Asian Metal pricing agency.

The Sangdong mine is being modernized, with vast underground tunnels being dug, while work has also begun on a tungsten crushing and grinding plant.

Kang Dong-hoon, a manager at Sang-dong, said the “Pride of Korea” banner is displayed on the wall of the mine office. headquarters. center.

“We have been lost in the mining industry for 30 years. If we lose this opportunity, there will be no more.”

Almonty Industries has signed a 15-year deal to sell tungsten to Pennsylvania-based Global Tungsten & Powders, a supplier to the US Army, which uses the metal differently in artillery shell heads, rockets and satellite antennas.

However, there are no guarantees of the long-term success of the mining group, which is investing about $100 million in the Sangdong project. Such projects may still struggle to compete with China and there are concerns among some industry experts that developed countries will not meet their commitments to diversify supply chains for critical minerals.

Seoul set up a task force on key elements of economic security after a supply crisis last November when Beijing tightened exports of urea solution, which many South Korean diesel vehicles are required by law to use to cut emissions. Nearly 97% of South Korea’s urea came from China at the time, and shortages led to panic buying at filling stations across the country.

The Korea Mine and Resources Rehabilitation Corporation (KOMIR), a government agency responsible for national resource security, told Reuters it had committed to subsidizing about 37% of tunneling costs in Sangdong and that it would consider providing more support to mitigate any potential environmental damage.

Incoming President Yoon Seok Yeol pledged in January to reduce reliance on minerals in a “certain country,” and last month announced a new resource strategy that would allow the government to share storage information with the private sector.

South Korea is not alone.

The United States, the European Union, and Japan have launched or upgraded national critical mineral supply strategies over the past two years, with extensive plans in place to invest in more diversified supply lines to reduce their dependence on China.

Mineral supply chains have also become a feature of diplomatic missions.

Last year, Canada and the European Union launched a strategic partnership on raw materials to reduce dependence on China, while South Korea recently signed cooperation agreements with Australia and Indonesia on mineral supply chains.

“Supply chain diplomacy will be prioritized by many governments in the coming years as access to critical raw materials for a green and digital transformation becomes a top priority,” said Henning Gloesten, Director of Energy Resources and Climate at Eurasia Consulting Group.

In November, China’s chief economic planner said it would step up exploration of strategic mineral resources including rare earths, tungsten and copper.

Global investment of $200 billion in additional mining and smelting capacity is needed to meet critical supply demand for minerals by 2030, Keitel said, ten times what is currently being committed.

However, the projects encountered resistance from communities who did not want a mine or smelter near their homes.

In January, for example, pressure from environmentalists prompted Serbia to revoke Rio Tinto’s license to explore for lithium while US President Joe Biden’s administration canceled two leases for copper and nickel mines in Antofagasta, Minnesota. Read more

In Sangdong, some residents doubt that the mine will improve their lives.

“A lot of us in this town didn’t really think the mine would make a comeback,” said Kim Kwang Gil, 75, who lived off decades of tungsten that flowed from a stream gushing out of the mine when it was working.

“The mine does not need as many people as before, because everything is done by the machines.”

Register now to get free unlimited access to Reuters.com

(Joo Min Park and Joo Brook report) The Beijing Newsroom and Gavin Maguire contributed reporting. Editing by Kevin Kroliky and Praveen Shar

Our criteria: Thomson Reuters Trust Principles.

“Infuriatingly humble analyst. Bacon maven. Proud food specialist. Certified reader. Avid writer. Zombie advocate. Incurable problem solver.”

More Stories

The rise in oil prices due to the Saudi and Russian production cuts

Bitcoin, Ethereum, Dogecoin Soar After SEC Ratings BlackRock Card ETF, Fidelity ‘Not Enough’ – Analyst Says King Crypto Could Hit $310K If Institutions Do

Los Angeles hotel workers go on strike