US stocks fell in early trading on Tuesday, while Treasury yields rose as the stock and bond markets continued to slide ahead of the third-quarter earnings season.

S&P 500 Index (^ Salafist Group for Preaching and Combat(Sink 0.6%, while the Dow Jones Industrial Average)^ DJI) is down 60 points, or 0.2%. Nasdaq Composite (^ ninth) is down nearly 0.7% after the tech-heavy index It reached its lowest level since July 2020 to start the week. Meanwhile, benchmark 10-year Treasuries tested 4% again.

Investors Sailing in a mysterious week It featured producer, consumer and first-line inflation data for the third-quarter earnings season, which includes four of the nation’s largest banks by assets.

Markets are still on the brink The government’s Consumer Price Index (CPI) is due to be released on Thursday, which is likely to show that inflation has remained consistently high despite aggressive intervention by the Federal Reserve to slow the economy. After the release of print August CPI On September 13, the S&P 500 fell 4.3% on its worst day of the year so far.

Analysts at JPMorgan warned in a note on Tuesday that if the September reading came in 8.3% higher than the previous month, the S&P 500 Index May Fall 5%.

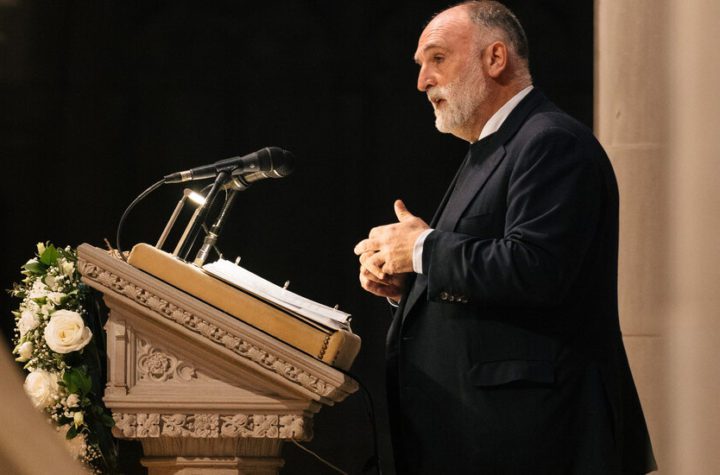

In a rare admission, Fed Vice Chairman Lyle Brainard Policy makers said you should be prudent Raising rates higher amid global macroeconomic uncertainty as previous highs are still working their way through the economy.

She said Monday at the National Annual Meeting of the Society for Business Economics, as the US central bank Looks like he’s fast paced for a fourth 75 basis points increase in november.

On Monday, JPMorgan CEO Jamie Dimon in an interview with CNBC He said stocks could fall “easy 20%” From current levels, depending on the economic outcome of the Fed’s actions, he also warned that the US economy could enter a recession by mid-2023.

Across the Atlantic, the Bank of England expanded in it Buying emergency bonds for the second time this week After selling through long-term government bonds on Monday in an attempt to stabilize financial conditions.

“The dysfunction of this market and the potential for reinforcing ‘quick selling’ dynamics poses a material risk to the UK’s financial stability,” the bank warned in a statement.

The Bank of England’s move helped push gold prices higher, but did little to help the weakening British pound as the US dollar strengthened and continued to pressure other currencies.

In the United States, the stability of the dollar resulting from the monetary actions of the Federal Reserve has led to this It was a pain for American companiesand reduced sales and profits by trampling on income earned abroad from products purchased in weaker currencies. Currency headwinds dealt a blow to companies like Nike (NKE) and FedEx (FDX) in recent weeks and is likely to be cited by others reporting financial results.

“We may hear more in the coming weeks about the pressures that an exceptionally strong dollar could put on US exports, and thus US corporate profits, but the dollar’s strength could also play a role in pushing the Fed back from its tightening policy,” said Chris Larkin, managing director. To trade in E*TRADE at Morgan Stanley, in an email comment. “Although the continued strength of the dollar ultimately contributes to the Fed’s shift from raising to lowering interest rates, the timing of such a pivot remains uncertain, and may not alters the downward trajectory of corporate earnings.

–

Alexandra Semenova is a reporter for Yahoo Finance. Follow her on Twitter Tweet embed

Click here for the latest trending stock indices for Yahoo Finance

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance

Download the Yahoo Finance app for apple or Android

Follow Yahoo Finance on TwitterAnd the FacebookAnd the InstagramAnd the FlipboardAnd the LinkedInAnd the Youtube

“Infuriatingly humble analyst. Bacon maven. Proud food specialist. Certified reader. Avid writer. Zombie advocate. Incurable problem solver.”

More Stories

The rise in oil prices due to the Saudi and Russian production cuts

Bitcoin, Ethereum, Dogecoin Soar After SEC Ratings BlackRock Card ETF, Fidelity ‘Not Enough’ – Analyst Says King Crypto Could Hit $310K If Institutions Do

Los Angeles hotel workers go on strike