(Bloomberg) –

Most Read from Bloomberg

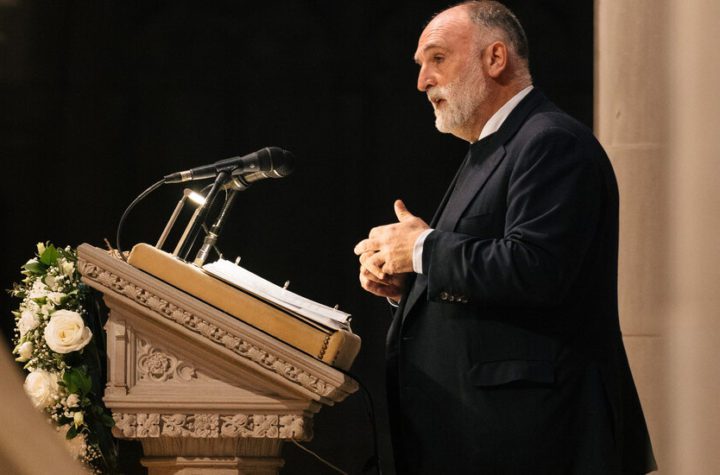

Ammar Al-Khudairi, the chairman of Credit Suisse Group AG’s largest shareholder, resigned just days after his comments helped trigger a slump in stocks and bonds, prompting the Swiss government to intervene and arrange its takeover.

Al-Khudairi, who became chairman of the National Bank of Saudi Arabia in 2021 when it was created by the merger of National Commercial Bank and Samba Financial Group, said he was leaving for “personal reasons,” according to a statement on Monday.

His departure comes twelve days after he said in a Bloomberg TV interview that Saudi National Bank would “absolutely not” be open to further investment in Credit Suisse if there was another call for additional liquidity.

The Swiss bank’s shares fell to an all-time low and credit spreads soared after his comments. This helped push all European banks lower as investors turned away from risk after the collapse of three US lenders.

“The Swiss National Bank chairman was a victim of giving his honest opinion at such a difficult time for Credit Suisse,” said Muhammed Ali Yassin, financial markets expert and investment advisor. In hindsight, given the rate of acquisition of CS by UBS, his answer was the right course of action: waiting for the crisis to be more pronounced.

In the days following his comments on Bloomberg Television, Khudairi sought to calm the market, telling CNBC that the panic surrounding Credit Suisse’s share decline was “totally unwarranted.”

While his statements were in line with the Saudi company’s previous position, Khudairi’s comments were largely seen as a turning point for Credit Suisse’s chances of survival. Days later, UBS Group AG agreed to buy Credit Suisse in a landmark government-brokered deal aimed at containing a crisis of confidence that was beginning to spread through global financial markets. UBS has offered to pay 3 billion francs ($3.3 billion) to rival it in an all-share deal that includes extensive government guarantees and liquidity provisions.

The National Bank of Saudi Arabia, which is 37% owned by the kingdom’s sovereign wealth fund, has seen the value of its investment in Credit Suisse drop by nearly $1 billion in a matter of months after it acquired nearly 9.9% of the shares for 1.4 billion francs last year. During that time, shares of National Bank of Saudi Arabia fell by about a third, wiping out more than $25 billion from its market value before Credit Suisse’s deal with UBS. The stock was trading up 1% in Riyadh on Monday.

Khedairy said in October that he “loves” the new leadership of Credit Suisse and their intention to implement the turnaround plan, but that any additional shares are currently “out of the question”.

Middle East support

Wealthy Middle Eastern investors have been supporting global banks such as Credit Suisse for many years. During the financial crisis, sovereign funds in Abu Dhabi, Qatar and Kuwait invested about $69 billion in companies such as Barclays plc, Merrill Lynch and Citigroup, according to boutique advisor and data firm Global SWF.

Credit Suisse’s recent losses are a stark reminder of a series of investments made by Gulf investors during the 2008 financial crisis – many of which ended in financial loss or legal battles. Regional investors are becoming more wary of making new investments in global banks after they emerged as one of the hardest hit in the Credit Suisse crisis.

Born in 1963, Al-Khudairi has spent his career in the financial sector in Saudi Arabia managing some of the best institutions in the kingdom. He was Chairman of the Board of Directors of Goldman Sachs Group and Morgan Stanley in Saudi Arabia.

Al-Khudairi also founded the alternative asset management company, Amwal Al Khaleej and Amwal Capital Partners, based in Riyadh and Dubai.

He will be replaced by Saeed Mohammed Al-Ghamdi, CEO of the Swiss National Bank. The bank also appointed Talal Ahmed El Khereiji as Acting Chief Executive Officer. He previously held the position of Executive Vice President and Head of Wholesale Banking at the Saudi lender.

— with assistance from Dana Khreish.

(Adds commentary and details on Khudairi throughout.)

Most Read from Bloomberg Businessweek

© 2023 Bloomberg LP

“Infuriatingly humble analyst. Bacon maven. Proud food specialist. Certified reader. Avid writer. Zombie advocate. Incurable problem solver.”

More Stories

The rise in oil prices due to the Saudi and Russian production cuts

Bitcoin, Ethereum, Dogecoin Soar After SEC Ratings BlackRock Card ETF, Fidelity ‘Not Enough’ – Analyst Says King Crypto Could Hit $310K If Institutions Do

Los Angeles hotel workers go on strike